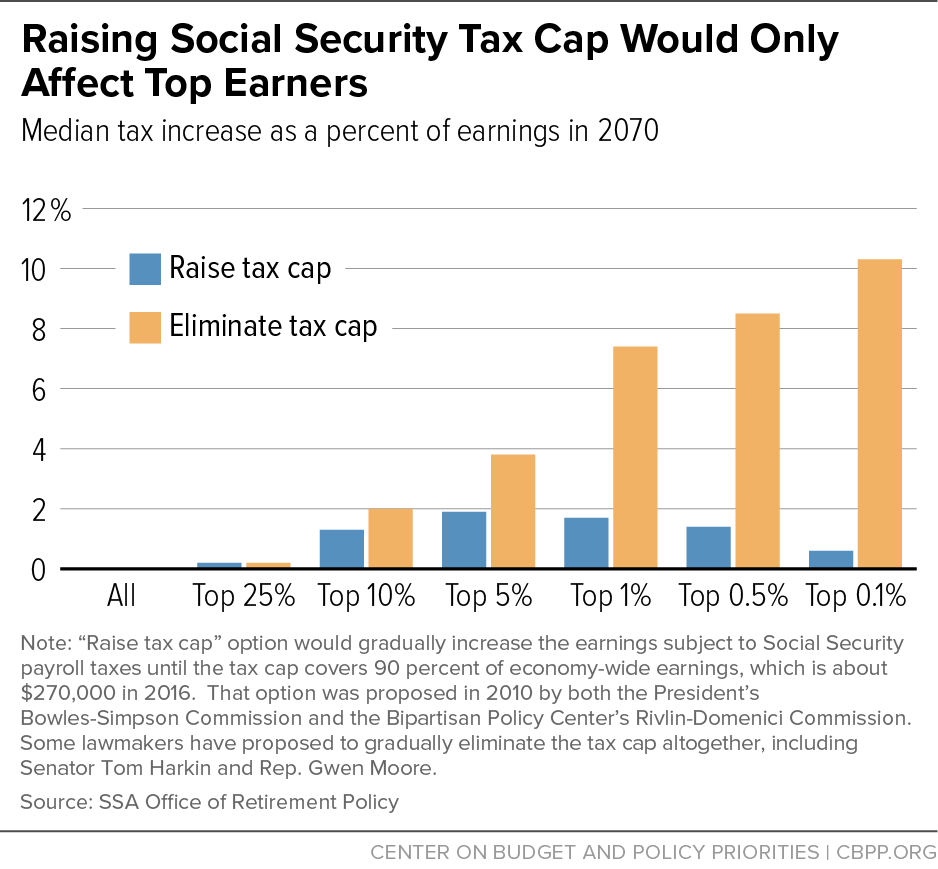

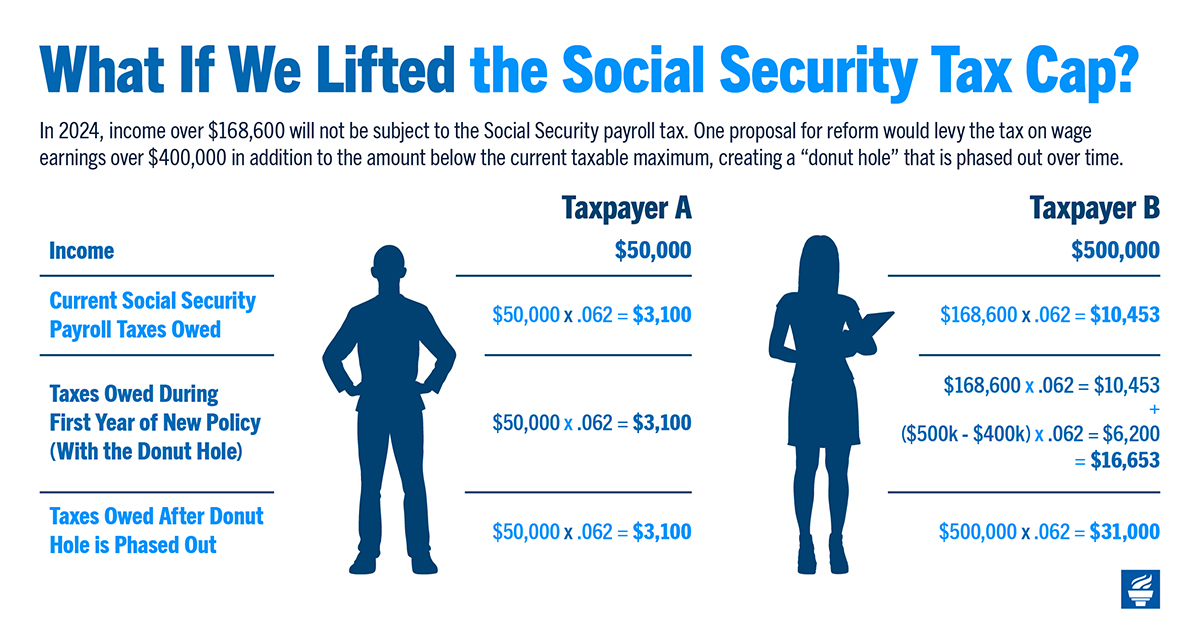

Removing the Social Security earnings cap virtually eliminates funding gap | Economic Policy Institute

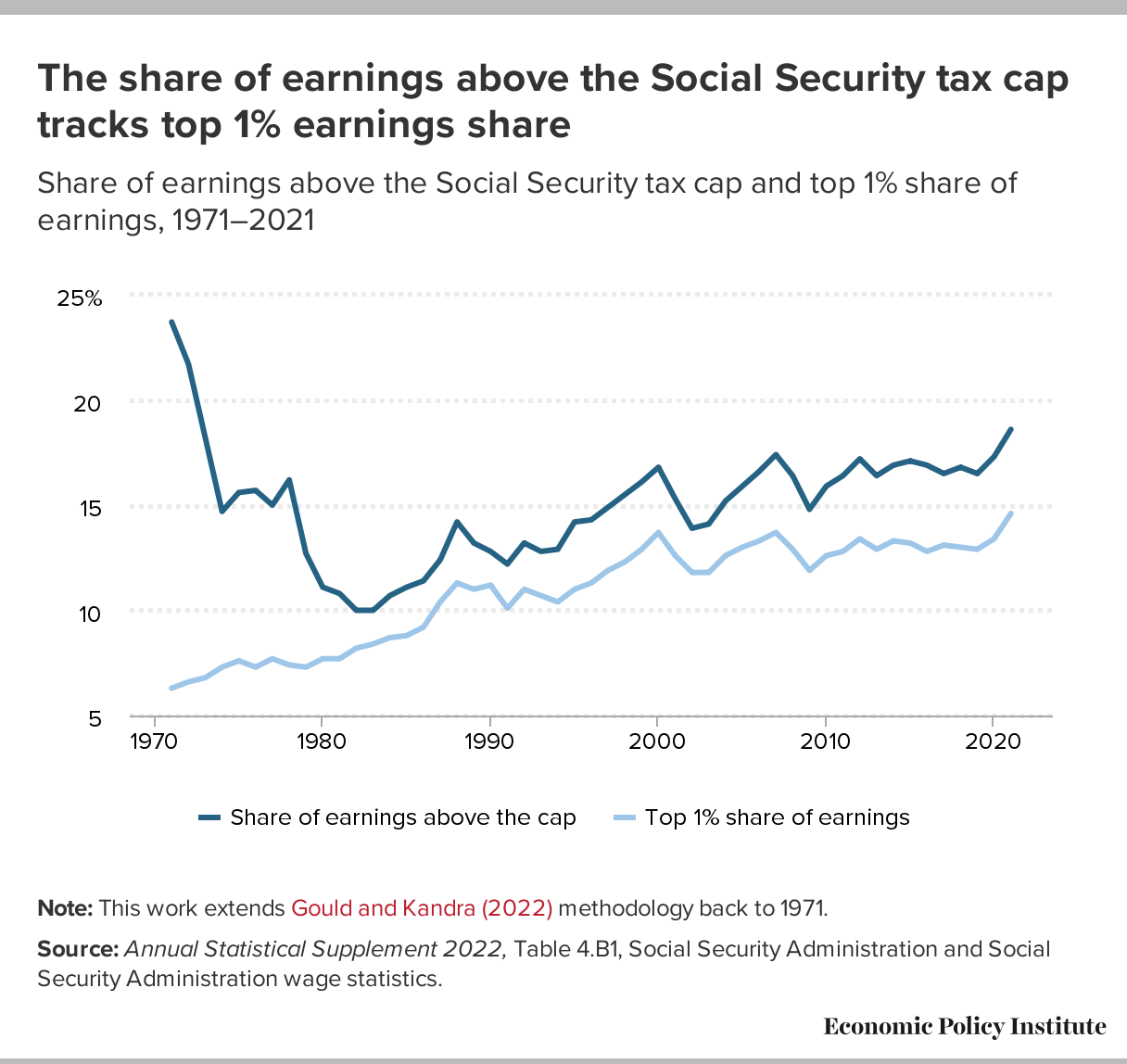

A record share of earnings was not subject to Social Security taxes in 2021: Inequality's undermining of Social Security has accelerated | Economic Policy Institute

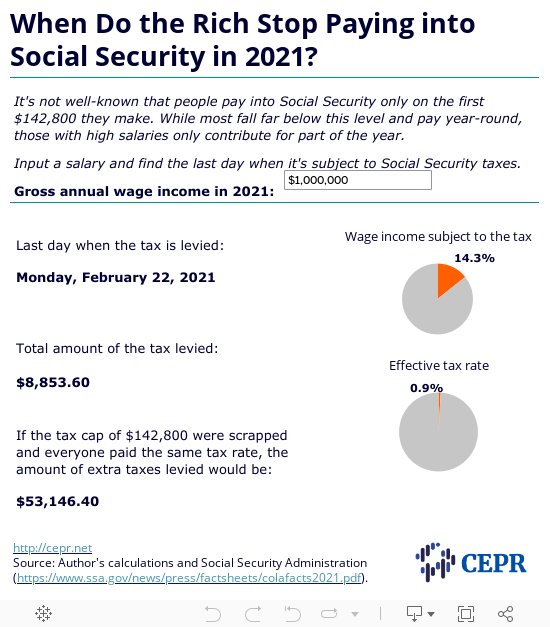

Wage Cap Allows Millionaires to Stop Contributing to Social Security on February 19, 2020 - Center for Economic and Policy Research

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)